Making Common Sense Common Practice

On reviewing current marketing plans, the new CEO has found that the marketing division is really more like a set of sales departments, focused more on selling whatever products R&D develops for it than on understanding and targeting markets and then developing their marketing and sales strategy accordingly. The R&D department has lots of neat ideas, but too often these ideas are not fully linked to a thorough market analysis and understanding of customer wants and needs. Manufacturing is not integrated into either process. There seems to be a "silo" approach to the business. Everybody's in their silo doing their very best to survive first, and assure their silo's success second, but few take an integrated perspective of the business as a whole and how they support the company's success.

Several issues have been developing for some time in its manufacturing division, and much of this is coming to a head at its new Beaver Creek plant. It's not yet apparent to the new CEO that the Beaver Creek production plant, which manufactures one of its new premier products, is in deep trouble-the process isn't performing as expected, the plant is frequently down because of equipment failures, the shop floor is hostile toward management, and morale is at an alltime low. This plant was to be the standard by which its other plants were operated, but has fallen far short of its goals. A new plant manager has been recently assigned to correct these problems, and seems somewhat overwhelmed by the magnitude of the job. Moreover, it's his first assignment as a plant manager for a plant this size and complexity, having spent most of his career in purchasing, quality assurance, and then marketing. While there are spots of isolated excellence, most other plants in the corporation are not faring much better, as evidenced by the fall in the company's share price over the past several quarters. Further, recent pressures on interest rates have added even more angst to this capital intensive company.

Most analysts recognize the problems facing Beta, and see intense international competition as a continuing threat to Beta International's long-term success, and perhaps even its survival in its current form. Inside the Beaver Creek plant, an operator and process engineer have recently come up with several ideas for improving their manufacturing processes, but are having difficulty convincing their boss, the production manager, to use their ideas for better process control-they cost too much, they are too risky, they require too much training, etc. Nearby, a similar situation has developed in the maintenance department where a technician and maintenance engineer have also come up with some ideas about how to reduce mechanical downtime. Likewise, their boss, the maintenance manager, believes they're too expensive and a bit "radical," and besides, he opines phrases like "if only people would just do what they're told, when they're told, everything would work just fine," or "if it ain't broke, don't fix it." Meanwhile, back in the design and capital projects department, they know that the plant was designed and installed properly, if only the plant people would operate and maintain it properly, everything would be just fine.

All the while, executives are following their traditional approach, intensifying the pressure for cost cutting in an effort to become more competitive. Simultaneously, they implore their staff to keep the plant running efficiently at all costs. Few, except for the people of the shop floor, have recognized the irony in this situation.

Challenges from global competition, challenges from within, challenges from seemingly every direction are all coming together to threaten the prosperity and perhaps the very existence of a longstanding, respected corporation.

The Players

Though based on actual companies and case histories, the above scenario is fictitious. There is no Beta International, or Beaver Creek plant, but it could very well describe the situation in many manufacturing companies today. Further, with some modifications, it could also reflect the situation in power utilities, automotive plants, paper plants, etc., and even in the government sector where a reduced tax base and pressure for cost cutting are creating intense pressure to improve performance. Beta International and its Beaver Creek plant, as well as other plants, are used in this book to illustrate real case histories that reflect the actual experience of various manufacturing plants, but the actual descriptions have been modified to mask the identity of the plants. Though based on real events, these case histories are not intended to describe any specific company's actual performance. Therefore, any correlation, real or imagined, between Beta and any other company is coincidental. Beta International is a composite of many different companies.

All businesses, and particularly manufacturers, are being called upon to do more with less. All are facing intense pressure, either directly or indirectly, from global competition, and all are behaving in very much the same way-cost cutting is a key corporate strategy. There is nothing inherently wrong with cost cutting, but it must be combined with a more strategic process for assuring manufacturing excellence. Cost cutting does little to improve the knowledge base that assures improvements in plant operation, in equipment and process reliability, and ultimately world-class performance.

So what are we to do? Well, most of us understand that if we don't grow our businesses, we just aren't going to be successful. We also understand that cost cutting typically reduces the effects of a growth strategy. Please do not misunderstand. Being prudent and frugal are hallmarks of good companies; and being the low-cost producer may be a necessity for long-term market leadership. However, too many companies focus on cost cutting almost to the aversion of growth, and/or the application of best practices, and over the long term may hurt their strategic position. Business excellence in most companies requires that the company do each of three things shown in Figure 1-1 exceptionally well-marketing, R&D, and manufacturing. Excellence in each is essential for long-term success, and each must be fully integrated with the other. Each must recognize certain overlapping areas where teamwork and cooperation are required, and that all areas must be fully integrated with a common sense of purpose-maximizing shareholders' financial return.

Each group must recognize mutual independence and dependence, but in the end, all groups must be synchronized to a common purpose

and strategy that fosters a sense of trust-we all have a common understanding of where we're going and how we're going to get there. It is common that a company at first will do a better job selling than it will understanding its markets and then developing a sales and distribution strategy to penetrate those markets. It is also common that considerable R&D may not be fully linked to the marketplace and customer requirements. Perhaps more to the point of this book, however, is that few companies do a good job integrating their marketing and R&D strategies with their manufacturing strategy, often treating manufacturing like a big reservoir from which sales "opens a spigot and fills their bucket with product" and then sells it. It's true of Beta International. While the thrust of this book is primarily manufacturing, it is critical that the manufacturing strategy be fully integrated with the marketing strategy. This is discussed in the following section and in additional depth in Chapter 3.

Integrating the Manufacturing and Marketing Strategy

There are several exceptional works about developing a manufacturing strategy and assuring its support for the marketing and overall business strategy. (1-5) These have apparently received insufficient attention until recently, but are now helping Beta to form its strategy, where manufacturing has historically been viewed by the marketing function as, in effect, "the place that makes the stuff we sell."

Beta understands well that all business starts with markets-some existing (basic chemicals, for example), some created from "whole cloth" (new process technology or unique instruments, for example). Beta was principally in mature markets, but of course was investing R&D into new product and process development. However, Beta was not actively positioning its products and its manufacturing strategy to assure an optimal position. Additional discussion on this, as well as a process for optimizing Beta's product mix is provided in Chapter 3, but for the time being, the discussion will be limited to the basis for integrating Beta's marketing and manufacturing strategy. What image does Beta want in its markets? What market share is wanted? What is the strategy for achieving this? Has Beta captured the essence of its business strategy in a simple, clear mission statement (or vision, or both, if you prefer)?

Using the model described in more detail in Chapter 3, Beta reviewed its 5-year historical sales for all its product lines, including an analysis of the factors for winning orders, Beta's market share, the gross margins for given products, and the anticipated total market demand for existing, and future products. Beta then reviewed its production capability, including each manufacturing plant's perceived capability for making a given product. More importantly, however, Beta's perception of manufacturing capability was balanced with a reality check through an analysis of historical delivery capability and trends for each plant's performance in measures like uptime and overall equipment effectiveness, or OEE (both defined below relative to ideal performance); unit costs of production for given products; ontime/in-full performance; quality performance; etc. They even took this one step further and looked into the future relative to new product manufacturing capability and manufacturing requirements for mature products to remain competitive. All this was folded into a more fully integrated strategy, one for which manufacturing was an integral part of the strategic business plan, and which included issues related to return on net assets, earnings and sales growth, etc.

Through this analysis, Beta found that it had many products that were not providing adequate return with existing market position and manufacturing practices, it lacked the capability to manufacture and deliver certain products (both mature and planned) in a cost-competitive way, and it could not meet corporate financial objectives without substantial changes in its marketing and manufacturing strategies.

Further, it was found that additional investment would be required in R&D for validating the manufacturing capability for some new products; that additional capital investment would be required to restore certain assets to a condition that would assure being able to meet anticipated market demand; and finally, that unless greater process yields were achieved on certain products, and/or the cost of raw material was reduced, some products could not be made competitively. All in all, the exercise proved both frustrating and productive, and provided a much better understanding of manufacturing's impact on marketing capability, and vice versa.

Further, a surprising finding resulted from Beta's effort. Historically, Beta's efforts had focused on cost cutting, particularly in manufacturing, and within manufacturing, particularly in maintenance. However, as it turned out, this approach was not enlightened. Indeed, in many plants it had resulted in a deterioration of asset condition and capability to a point where there was little confidence in the plant's capability for achieving increased production to meet marketing's plan for increased sales.

Other issues, such as poor performance in quality products at a lower cost/price, and less than sterling perfor mance for on-time/in-full delivery to customers, only exacerbated the situation. After extensive review and intensive improvement efforts, manufacturing excellence became more than just a nice word. Measures associated with manufacturing excellence, asset utilization rate and unit cost of production became paramount, and the comprehensive integration of manufacturing, marketing, and research and development to achieving business success became better understood. For example, Beta began to adopt the philosophy stated by another major manufacturer:(6)

As a result of our global benchmarking efforts, we have shifted our focus from cost to equipment reliability and Uptime. Through our push for Uptime, we want to increase our capital productivity 10%, from 80 to 90% in the next several years. We value this 10% improvement as equivalent to US$4.0 billion in new capital projects and replacement projects for global Chemicals and Specialties.

Maintenance's contribution to Uptime is worth 10 times the potential for cost reduction. Realizing this tremendous resource has helped make Uptime our driving focus for future competitiveness rather than merely cost reduction.

While prudently and properly saving money is a good thing, Beta is only now beginning to recognize that it will be difficult to save their way to prosperity; and that capital productivity must be included with labor productivity in their management measurements. Consider the following example:

Beta's Whamadyne plant had been "encouraged" to cut labor costs by some 10%, amounting to a "savings" of $2m per year. At the same time, Whamadyne was measured to be one of Beta's best plants, having an asset utilization rate of some 86%. (It was manufacturing 86% of the maximum theoretical amount it could make). Whamadyne management developed a plan to increase utilization rates to 92% by improving process and equipment reliability, without any major capital expenditure.

Further, it was determined that this increase was worth an additional $20m in gross margin contribution, most of which would flow directly to operating income. It was also determined that requiring a force reduction would jeopardize this improvement. What would you do? What did they do? They took the risk and achieved much better performance in their plant, and therefore in the market place; and their maintenance costs came down more than the $2m sought; and they managed the need for fewer people over time through natural attrition, re-allocation of resources, fewer contractors. Genuine "cost cutting" comes through process excellence, not simply cutting budgets.

Becoming the Low-Cost Producer

So what are we to do again? In manufacturing, there is almost always greater supply than demand, requiring that a given plant focus on becoming the low-cost producer of its products. Granted, there are also other market differentiators, such as product quality, delivery performance, customer service, technology, etc., but a key business indicator is the ability to produce quality product at the lowest achievable cost for a given targeted market segment. This helps assure greater return on assets for further investment in R&D, marketing and distribution channels, etc., to further improve a company's business success. Consider Figure 1-2, which represents three companies competing in a market where the market price is variable depending upon the state of the marketplace, the economy of a given region, etc. Each manufacturer makes its product(s) for a given unit cost of production that includes fixed costs, variable costs, capital costs, etc. For the purpose of this discussion, we've assumed that these are products of comparable quality for a given specification in the marketplace.

Company C is the high-cost producer. One year it may make money, the next year it may lose money, but all in all, it may not survive very long, because it is not generating enough working capital to sustain and grow the business.

Given this scenario, it is bound to change, one way or another. It is typically fighting for its very survival, and therefore, it must embark on a course to improve its performance, typically by cutting its operating costs. It is also typically characterized by a reactive, crisis-driven manufacturing and corporate culture. It may even complain that its competitors "must be selling below cost." And, whether it stays in business is, in some measure, determined by competitors, which want prices high enough for good margins, but not too high to attract additional competition.

Company B is the mid-cost producer. Most years it makes money, and some years it makes considerably more money, but it is not viewed as the best in its industry. It tends to be complacent with its position, because it's typically been around for decades, it has almost always made money, and it is respected in its industry as a good company (but not the best). Sure, the management team recognizes that they have a few problems, but doesn't everyone? The compelling reasons for change seem more obscure, and are often taken less seriously. While perhaps less so than Company C, it too is often reactive in its management practices, and often driven by the "crisis" of the moment; or by the latest management fad, which it rarely executes well, because a kind of "this too will pass" attitude often prevails at the operating level.

Company A is the low-cost producer. It essentially always makes money, and in some years, it is very prosperous indeed. Notwithstanding market forces, it is in a better position to determine market price. It wants the price high enough to assure good margins, but not so high that new competitors are tempted to make major capital investments. It will work hard to assure that Company B and Company C are not overly aggressive in pricing, in either direction. It too is generally compelled to change, but for very different reasons from Company C. Its basic mode of operation requires, rather than prefers, the company to be the low-cost, high-quality producer with high market share. Company A has also done a good job integrating its marketing and manufacturing strategy by continuously balancing the drive for higher margins against market share. Its basic culture is one in which constancy of purpose and manufacturing excellence as determined by uptime, unit cost of production, delivery performance, and safety are a key focus throughout the organization. Manufacturing excellence, continuous improvement, and being the low-cost producer are inherent in its culture.

The unit cost of production in its simplest form can be characterized as the total cost of manufacturing divided by the total throughput (capacity). With this simple equation, there are three basic ways to lower the unit cost of production.

1. Cut costs while holding production capacity constant.

2. Increase production while holding costs constant.

3. Reduce cost and increase production simultaneously.

The difference between the best companies and the mediocre/poor ones in this model is the emphasis the best companies give to the denominator. That is, they focus on maximizing the capacity available through applying best practices and assuring reliability in design, operations, and maintenance, and through debottlenecking. They then use that capacity to go after additional market share, with little or no capital investment. Note also that in doing this, they also minimize the defects which result in failures and additional costs. In other words, they get a bonus-lower operating and maintenance costs. This helps further assure low cost production and competitive position. Make no mistake, they do not make products just because they can, creating excess inventory, but rather respond to demand as incurred.

However, having the capability to respond to the market with both existing and new products, without significant incremental capital investment, gives them a major competitive advantage. The marketing and sales staff can then make decisions about applying this capacity, pricing and market share, based on manufacturing performance. On the other hand, the typical manufacturing company tends to focus on the numerator, that is, cost cutting, while hoping to hold throughput constant. The best companies focus on improving the reliability of their production operation, thereby improving performance for a given fixed asset, and assuring lower unit costs of production.

Further, they get a bonus-by operating reliably, they aren't always "fixing things," nor routinely, and inopportunely, changing from one product to another to accommodate markets and customers. Good practice, reliable operation, reduces operating costs.

A key point is necessary here. The A's do not ignore costs. Quite the contrary, they are very cost sensitive, expecting to be the low-cost producer. They also expect that costs will continue to come down as they apply best practices. But their principle mode of operation is not to focus on cost cutting as a "strategy" in itself, but rather to focus on best processes and practices; whereas, the mediocre and poor companies use cost cutting as a principle means for success, while expecting that capacity will be available when it is needed. This approach can work, but it rests on the ability of the people at lower levels within the organization to somehow rise to the occasion in spite of what many of them perceive as poor leadership. The higher probability of success rests with focusing on best practice such that the capacity is available when necessary, and such that costs are lowered as a consequence. Strategically, this also lowers incremental capital requirements.

Company A, as the low-cost producer, is in a much better position to decide whether it wishes to pursue a strategy of increasing market share through lower prices and reliability of supply, yet still achieving good margins; or by holding market share relatively constant assuring very healthy profits, which would finance future investments. However, all three companies must consider that over the long term the price of most manufactured products tends to trend downward. Company A is in a better position relative to future developments, principally because it is driven to hold its position as low-cost producer. Companies B and C are at greater risk if prices do fall, and surprisingly Company B may be at particular risk, because it is likely to be more complacent than Company A and Company C, who are compelled to change, but both for different reasons.

Application of Increased Capacity

Of course, you can't simply make all the product possible, overstock on inventories, drive up costs, etc. However, what strategy should you employ? If capacity could be increased, could all of the additional product be sold? At what price? At what volume would prices have to be lowered to sell any incremental volume. What capacity (asset utilization rate, uptime) is needed to assure competitive position? Should we rationalize certain assets? And so on.

Figure 1-3 provides an easy way to map manufacturing performance with market conditions and quickly judge its impact on financial performance. It plots return on net assets (or gross margin/profits) as a function of uptime (and/or unit costs) for given market prices. For this chart, the logic goes something like this. For a given plant, you could determine what your current asset utilization rate or uptime is. For that uptime, and when combined with current operating costs, you could also determine what your current unit cost of production is for a given product set. With a large number of products this may get a little more difficult, but some companies use the concept of equivalent product units (EUs) for this purpose. For a given unit cost, and in a given market condition (price) you could also determine gross profit, and subsequently return on net assets (RoNA). In fact, for a family of prices you could determine the uptime required to achieve a given RoNA.

Beta International's new CEO, Bob Neurath, has recently completed a review of a benchmarking effort centered on Beta's financial and manufacturing performance, and has concluded that Beta is resoundingly average. While there are a few pockets of excellence, over time a complacent culture has evolved within the company,where mediocrity is the standard, and where only a few are substantially above average. This evolution has only been exacerbated by the fact that when problems have arisen, the typical response has been to "engineer a solution" (and spend more capital), rather than stepping back to determine whether or not best practice has been applied and best performance has been expected. After all, "they've been around for decades and have been fairly profitable; sure they've got some problems, but doesn't everyone; they're a pretty good company."

Being "pretty good" and presuming the future is secure because the past has been successful are the beginning of the end for many companies. And at Beta this has become unhealthy, particularly in light of the increasing intensity of competition, and other ills of the company. Further, increasing global competition represents both threat andopportunity. Threat for those who are complacent, but opportunityfor those who can aggressively capture those new markets. In any event, Mr. Neurath believes these issues represent opportunities, not problems, and that Beta International must view the global situation as opportunity. The challenge then is to establish new standards for performance and behavior. Beta must be the low-cost producer, among other factors, to assure market position and prosperity.

Beta's Beaver Creek Plant-RoNA vs. Uptime

Reviewing Beta's benchmarking data, we find from Figure 1-3 that Beta's Beaver Creek plant has been operating at an uptime of 63%, relatively poor, and likely leading to a position of no better than what could be characterized as mid-range-a low-end Company B. Because Beta believes that it can sell every unit of product it can make at Beaver Creek, for purposes of this discussion, uptime is defined as that percent of product a plant is making compared to that which it could make under ideal conditions-running 8,760 hours per year at 100% of peak demonstrated sustainable rate, making 100% quality product. However, it is believed that Beaver Creek could increase uptime from 63% to 77% in one year by taking the appropriate steps, and the marketing department has said that all the product could be sold at current market price. They grudgingly note that they are currently buying product from a competitor to meet customer delivery schedules. The value of this increased output translates into an increase in RoNA from just under 15% to 22% at a market price of $10/unit. After this analysis, the marketing department has also noted that even if market pressures forced the price down to $9/unit to sell additional product, or to construct a long-term alliance with key customers, RoNA still increases to over 18%. Note that Beta does not want to start a price war with its pricing, just improve itsfinancial and marketing position, and its options. Further, under a more extreme scenario, RoNA would remain the same even if market price dropped to $7/unit, with a concurrent uptime of 83%. This kind of information is very useful in the thinking process and in creating a common theme for marketing and manufacturing. Chapter 3 describes a process for more fully integrating the marketing and manufacturing strategies.

A Model for Becoming the Low-Cost Producer

Bob Neurath has concluded that all Beta's plants must develop this type of information, which will in turn be used in creating a longterm business strategy that links marketing and manufacturing into an understanding of the sensitivities for a given level of performance. Indeed, the data indicate that uptime and RoNA are mediocre at best. Further, once understood, this information can be used to position the company strategically with certain key customers in key markets. One marketing strategy is to strategically position with key customers and offer to reduce prices modestly over the coming years, in return for a minimum level of business, recognizing that manufacturing performance must also improve to provide a reliable supply to those customers, and concurrently improve RoNA. This approach is expected to create a strategic alliance between Beta and its customers, which will assure both market share, as well as an adequate return on assets. This information can in turn be used to help Beta to understand the profits/RoNA at which it can operate for a given market price and manufacturing level of performance, and then adjust business objectives consistent with current and strategic capability. Put more simply, Mr. Neurath has directed the operating units to:

1. Determine the unit cost of production needed to assure market share leadership (among other factors).

2. Determine the uptime, or overall equipment effectiveness, required to support this unit cost.

3. Determine any additional fixed or variable cost reductions necessary to achieve this targeted unit cost.

4. Validate the feasibility of achieving the targets.

5. Determine the key steps required to achieve that uptime and those key cost factors.

6. Presume success (presumptive market positioning) in achieving that level of uptime, unit cost of production, and market share. Proceed accordingly, and in parallel. Marketing and plant operations must work as a team to drive the improvement process.

7. Allow people within operating units considerable freedom to do the job right and assure maximum reliability and uptime, and plant operational success.

8. Measure and manage along the way.

Some plants will not be able to achieve a unit cost of better than about 110-120% of the recognized lowest-cost producer. Current technology, physical limitations, raw material costs, etc. limit the ability of these plants, even in the best of circumstances from being the lost-cost producer. This in itself is useful information in that it provides an understanding of what is possible with existing assets, and how the company may need to strategically re-think the business and its long-term fit into corporate objectives. Short term it also supports greater understanding and teamwork between marketing and manufacturing.

Further, Mr. Neurath has reluctantly accepted that it will probably take 2-4 years to achieve substantially improved manufacturing performance, and perhaps even longer to achieve world-class performance at most of Beta's plants, given their current condition and level of performance. That said, he is pressing very hard for implementing the processes to achieve this level of performance.

Steps to Manufacturing Excellence

But how will Beta's operating managers determine the key next steps for what each of the operating plants are specifically to do?

• The first step in the improvement process is to determine where you are as compared to the best. How do you compare to world-class companies, in uptime, in unit cost, in on-time/in-full measures, for example? How do you compare to typical companies? To do this, you must do some benchmarking. This generally creates some cognitive dissonance, or positive tension, because it creates an awareness of just how big the gaps are between typical and world-class performance. When properly applied, this knowledge can lead to improved performance. More on that in the next chapter.

• Next, you must determine where your losses are as compared to ideal circumstances. This requires a system that allows you to track every hour in which you are not operating at the ideal rate, and assign a reason for the failure to perform at the ideal rate. This can then be used for analysis of key losses and key steps for eliminating those losses, and is discussed in the following. While putting this system in place, if you don't have one yet, you can identify the major causes of losses using the technique described in Chapter 2.

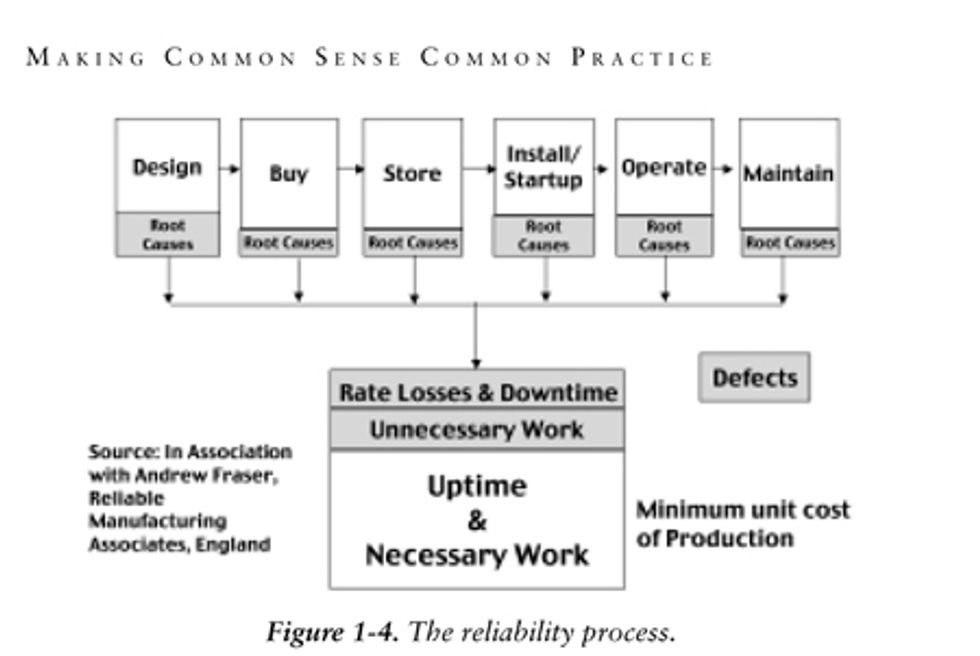

• Finally, you must compare your practices to best practices. Note that this differs from benchmarks, or numbers. Practices are what you do, not how you measure. The best manufacturing companies position themselves to design, buy, store, install, operate, and maintain their assets for maximum uptime and reliability-reliability of

production process and reliability of equipment. Best practices in each of these areas are described in detail in chapters 4-13. Further, the best plants integrate their manufacturing strategy with their marketing strategy and plan, as described in Chapter 3. Consider Figure 1-4, the reliability process for manufacturing excellence.

Beta International must position itself to do all these things exceptionally well. Doing poorly in one of these areas introduces defects into the processes. These defects flow down into our manufacturing plants, resulting in lost capacity and higher costs. Further, if a mistake is made upstream in the reliability process for manufacturing excellence, it tends to be compounded downstream as people try to compensate for the mistakes within their organization. Beta must be able to use the knowledge base reflected by best practice and from within the operations and maintenance departments to provide feedback into the design, procurement, storage, and installation efforts, as well as into the operating and maintenance functions, to help minimize the number of defects being created. Beta must use this knowledge base to eliminate these defects and losses in its drive for excellence in manufacturing.

Note also that most of the defects are introduced as a result of our design, installation/startup, and operating practices. This data is based on a review of the Uptime/OEE data from several large companies with multiple operations world wide. And, while the data is only approximate and may vary from site to site, it highlights the need to assure excellence in design, installation and startup, and operation if we expect to minimize production losses and maintenance costs. More on the details of exactly how this is done as we continue.

To eliminate defects and losses from ideal, we must understand what ideal is, and measure all our losses against ideal. For example, if in an ideal world you could operate your plant 8,760 hours per year (that's all there are except for leap year when you get an extra 24 hours), making 100% quality product, at 100% of your maximum demonstrated sustainable rate, with an optimal product mix (no downtime for anything-changeovers, planned, unplanned, etc.), how much could you make? Certainly this would be ideal, and it is recognized that no one will ever be able to achieve this. The more important issue, however, is how close can we get to this, and sustain it? Let's measure our losses from ideal, and then manage them. If we don't have sufficient market demand, why? If we have extensive unplanned mechanical downtime, why? And so on-measure it, manage it, eliminate or minimize the losses from ideal. Moreover, we may also find that some assets must be rationalized, that is we can produce at market demand requirements with substantially fewer capital assets, necessitating that some be decommissioned or even scrapped. While this may be a painful thought, given the original capital investment, it may be better to stop spending money to retain a non-productive asset, than to continue to spend money ineffectively.

Measuring Losses from Ideal

Figure 1-5 illustrates a general definition for uptime, overall equipment effectiveness (OEE), or asset utilization and the losses related thereto. The terms in Figure 1-5 are defined as follows: (6)

• Asset utilization rate-That percentage of ideal rate at which a plant operates in a given time period. The time period recommended is 8,760 hours per year, but this can be defined as any period, depending on how market losses are treated.

• Uptime or Overall Equipment Effectiveness (OEE)-That percentage of ideal rate at which a plant operates in a given time period, plus the time for no-market-demand losses.

• Quality Utilization-That percentage of ideal rate at which a plant operates in a given time period, plus market demand losses, and changeover and transition losses.

• Potential Rate Utilization-That percentage of ideal rate at which a plant operates in a given time period, plus market demand losses, changeover and transition losses, and quality losses.

• Availability-That period of time the plant is available to run at any rate.

These terms can be confusing, depending upon any individual's experience base-hence the effort to define them. For example, many people refer to uptime as any time a line or plant is up and running.

For them, this does not mean that it is being run in an ideal way, just that it's up and running, regardless of rate, quality, or other losses from ideal. Further, it may be necessary to introduce other categories, depending on the nature of the business and the losses. For example, utility downtime may be a critical category for loss accounting. Production paperwork for the FDA in the food and pharmaceutical industries may represent key losses. The point is to develop a model that accounts for all losses from ideal, and then use that model to manage and minimize those losses, all things considered. The goal with this methodology is to assure that "there's no place to hide" any losses from ideal. Once we account for those, then we can truly begin to manage them in an integrated way. Indeed, we may find that some so-called "losses" are entirely appropriate, and assure optimal performance over the long term. For example, planned maintenance "losses," product changeover "losses," etc. are an integral part of business excellence when properly done.

Beta's continuous plants have adopted the term uptime, while the batch and discrete plants have adopted the term OEE. Other companies and plants use other terms such as Operating Asset Utilization, Operating Plant Efficiency, or other term with which they are comfortable. Beta's plants generally apply the concept of measuring asset utilization in both a tactical and strategic sense. Tactically, it provides a measure of day-to-day performance, and supports focus on key losses and eliminating their root causes.

Strategically, it provides a measure of the effective use of capital (or not), and supports analysis of new capital requirements needed for additional market share. Applying the measurement in both modes is essential. Further, sustainable peak rate is, as the name implies, that maximum rate demonstrated to be sustainable for an extended period. Many of Beta's plants have used their best 3-day performance ever; others have used their best production run ever, etc. The point is to use a rate that represents a serious challenge, but is not totally unrealistic. Realism comes when you compare your actual rate to the best you've ever done.

Scheduled and Unscheduled Downtime. These are normally, though incorrectly as we will see, considered the sole responsibility of maintenance. Unscheduled downtime is typically for breakdown or reactive maintenance. Scheduled downtime is typically for preventive maintenance or PM as well as corrective and/or planned maintenance. In supporting business excellence measurements, we generally want to eliminate, or at least minimize, unscheduled downtime; and we want to optimize (minimize for a given effect or goal) scheduled downtime using a PM optimization process (Chapters 9 and 10) that combines preventive, predictive, and proactive methods with equipment histories and knowledge of current condition to assure doing only what is necessary, when it is necessary. Subtracting these times yields actual availability.

With this in mind, it has been Beta's experience that much of the unscheduled downtime for equipment maintenance has a root cause associated with poor operational practice, e.g., pump failures being caused by running pumps dry and burning up the seals (a root cause review at one of Beta's plants found 39 of 48 seal failures were due to operational error); by running conveyers without operators routinely adjusting the tracking; by poor operator TLC (tightening, lubricating, and cleaning using so-called TPM principles discussed in Chapter 13), etc. Hence, it is important that operations and maintenance work as a team (see Chapter 15) to identify the root cause of unscheduled downtime, and minimize it. Minimizing scheduled downtime also requires teamwork, particularly in integrating the production and maintenance schedules so that PM can be performed as scheduled, minimizing perturbations in the maintenance planning and scheduling effort, and assuring proper parts, resources, testing, etc. Properly done these losses can be minimized and support cost reduction in manufacturing costs, poor delivery performance and time delays due to equipment failures, and improved inventory planning through increased reliability.

Process Rate Losses. Generally, these are losses that occur when the process is not running in an ideal manner, e.g., production process rates at less than ideal, cycle times beyond the ideal time, yields at less than ideal, etc. These too can be caused by either operational or maintenance errors, e.g., if a machine or piece of equipment has been poorly installed, resulting in the inability to operate it at peak rate, then it's likely that a design or maintenance problem exists; or fouling in a heat exchanger could be due to improper gasket installation by maintenance, poor process control by operations, poor piping design, or some combination. Measuring the losses from the ideal is the first step in motivating the drive to identify the root cause. Subtracting these losses results in potential rate utilization.

Quality Losses. These are usually losses due to product quality not meeting specification, resulting in scrap or rework being necessary. It too can be the result of poor design, operational or maintenance practices, or some combination. In some cases specific measures are put in place for the cost of various drivers of quality non-conformance. However, these quality losses are generally a small fraction of the total losses from ideal. One concept is to use the overall uptime/OEE and related losses as a measurement of the cost of process quality non-conformance. In any event, subtracting the straight quality losses such as scrap and rework, a measure of product non-conformance, results in quality utilization.

Changeover/Transition Losses. These include downtime losses, derate losses, and/or, product quality losses that occur during a changeover or transition to a new product, both the shutdown losses for the existing product, as well as the startup losses for the new product. Minimizing the changeover and transition losses will help minimize manufacturing costs. Changeovers, as we'll see in Chapter 3, can represent a huge potential for losses, particularly when product mix, marketing and manufacturing issues are not well integrated. Subtracting changeover/transition losses results in uptime/OEE, or product utilization rate.

At this point, after subtracting all these losses from ideal, we have reached a measurement of uptime or OEE as defined in Figure 1-5, and which takes credit for the no-demand and market losses. If our market losses are near zero, then uptime/OEE and asset utilization rates are the same. However, if, for example, we only run a 5-day, 2-shift operation, then our market losses are quite high-we're only operating 10 of the 21 shifts available for a given asset. Alternatively, we could measure OEE only for the time run-e.g., 5-day, 2-shift operation-excluding market losses from consideration. In other words, we can characterize OEE as the sum of asset utilization plus no-demand and market losses, which is more common in continuous process plants; or we can characterize it as the operating efficiency for a given period of time such as a 5-day, 2-shift operation and ignore market losses. Either model works as an improvement facilitator, but identifying all losses, including market losses, and using asset utilization as a key performance indicator is more likely to drive senior management in the improvement process. It will also help senior management identify tactical operating performance, as well as strategic capital requirements.

Other Issues Relative to Losses from Ideal. We could include any number of categories in addition to those shown, e.g., break times, wherein machines are shut down during breaks, and might not otherwise be down, if the scheduling of resources accommodated not shutting the equipment down. We might also detail losses due to utility interruptions for steam, electricity, compressed gases, which we want to account separately. We might want to break out unscheduled downtime into categories associated with maintenance errors and operational errors. The model in Figure 1-5 is simply a tool we use to determine our losses from ideal, and how close we can come to ideal performance as we have defined it, and to managing and minimizing those losses. A few points need to be highlighted:

1. We frequently make legitimate business decisions that these losses from ideal are acceptable, in light of current business goals, product mix, technology, staffing, union agreements, etc. The point is that we want to measure these losses and then make a thoughtful business decision about their acceptability and reasonableness.

2. It is important to distinguish between industrial standards, such as 150 units per minute on, say, a production line, and ideal standards, such as 200 units per minute in the ideal world. The first is used for production planning and recognizes current performance for management purposes. The second is a measure of ideal performance against which we judge ourselves for making process improvements toward this ideal.

3. As we de-bottleneck and make our improvements, we often find that equipment can run under ideal circumstances at higher rates, e.g., 220 units per minute. We then adjust our industrial production planning standards, as well as our ideal standards upward to accommodate the measurement still being used against ideal performance. Uptime or OEE is a tool, not an end, for performance improvement. We use industrial standard rates for production planning, we use "perfection" rates for OEE measurement as an improvement facilitator, and we use measures such as unit costs of production as a measure of the desired outcome.

No-Demand and Market Losses. These generally refer to those losses associated with a lack of market demand. The manufacturing staff has little short-term influence on market demand. However, it is critical to the long-term success of the business to highlight this equipment and process availability for strategic decision making regarding gaining additional market share, new capital requirements and/or for capacity rationalization.

Tactically, uptime or OEE is a measure of the daily operating effectiveness of the manufacturing function. It seeks to minimize all losses from ideal and to reach a point where the losses are acceptable from a business perspective; and where production rates are sustainable at a minimal cost of goods sold, all things considered.

Strategically, asset utilization represents the opportunity to strategically position corporate assets toward new products and/or greater market share (and minimal unit cost), or to decommission certain assets that are no longer needed, and the cost of which is not justified in light of current performance. It is understood that certain lines may not be decommissioned in the short term because of company qualification standards for which a given production line may be uniquely qualified. But, this should at least highlight the need to do a trade-off analysis for sound business planning, and for not incurring any unnecessary operating and maintenance costs.

Tactically and strategically then, uptime/OEE and asset utilization rates support decisions related to the following, assuring maximum return on capital:

1. Additional production capability for the sale of new products.

2. Additional production capability for the sale of existing products.

3. Daily operating performance.

4. Contract manufacturing for other companies.

5. Reduction in the number of production shifts and costs at a given facility.

6. Mothballing of appropriate production lines for appropriate periods to reduce costs.

On which processes should we be measuring uptime or OEE? The answer to this question is more problematic. Because of plant configuration, product mix, etc., it may not be possible to measure uptime/OEE or asset utilization on all processes. The logistics may just be too difficult, and/or most staff may not be trained to even think in terms of uptime or OEE. At Beta, the approach being used for those difficult situations is to map key processes and select those that (1) are bottlenecks to many finished products; (2) have the highest volume; (3) have the highest gross margin contribution; (4) have the largest quality losses; (5) are considered representative of a number of products or processes; or (6) are some combination or other criteria. Using this approach to narrow your focus will help alleviate getting too bogged down in the logistics of the improvement process, and allow focus on the critical production processes and issues.

On which processes should we be measuring uptime or OEE? The answer to this question is more problematic. Because of plant configuration, product mix, etc., it may not be possible to measure uptime/OEE or asset utilization on all processes. The logistics may just be too difficult, and/or most staff may not be trained to even think in terms of uptime or OEE. At Beta, the approach being used for those difficult situations is to map key processes and select those that (1) are bottlenecks to many finished products; (2) have the highest volume; (3) have the highest gross margin contribution; (4) have the largest quality losses; (5) are considered representative of a number of products or processes; or (6) are some combination or other criteria. Using this approach to narrow your focus will help alleviate getting too bogged down in the logistics of the improvement process, and allow focus on the critical production processes and issues.

This article was excerpted from Making Common Sense Common Practice, Models for Manufacturing Excellence, 3rd Edition by Ron Moore, P.E. available at the MRO-Zone.com Bookstore for immediate delivery

Click here to read Part 2