There are ever-increasing opportunities to create new and sustainable value in asset-intensive organizations through enhanced use of technology.

This article explores how best to integrate these new methodologies and technologies in pursuit of improved value creation and demonstrates that the International Organization for Standardization’s (ISO’s) asset management standard, ISO55000, provides the correct supportive environment for asset performance management (APM) and asset investment planning (AIP) to be successful.

Value Creation: The Cutting Edge of Combining ISO55000 and Digitization in Asset Management

Organizations invest in assets and implement asset management (AM) programs to gain benefit (value) from the use of their assets. In asset-intensive organizations, there is a thin line between success and failure in organizational endeavors, with huge benefits to be gained from being on the positive side of the line and organizational erosion if on the negative side. However, this article puts forward the theory that employing process in combination with technology significantly enhances the probability of success.

Companies, organizations and individuals improve their viability by a continuous string of decisions about optimizing, protecting and benefiting from assets under their control. Poor decision-making leads to value erosion. In many cases, these decisions are made with partial or no information. This results in suboptimal decisions and outcomes. On the other hand, better or improved decisions regularly enhance the value of organizations.

According to Vetasi, a global asset management consultancy and supplier of APM solutions, two key approaches, when applied in concert, will enable value-creating decision-making. They are:

- Aligning to the ISO55000 standard on asset management;

- Embracing the digitally-enabled world (digitization) around the assets (often also referred to as the Industrial Internet of Things (IIoT).

The first approach provides a contextual system for making decisions linked to organizational objectives, while the second approach facilitates coherent decision-making based on evidence.

Experience is proving that organizations that effectively combine these approaches are adding significant, measurable value in both the short and long term.

The Concept of Value

Value has different meanings and priorities depending on the perspective from which one views it. For example, purchasing a new car may mean the most affordable purchase price to one buyer, the perceived prestige from driving such a car to another, and the low exhaust emissions to another person. All three motivations are driven by a value concept.

Value in asset-intensive organizations is enhanced by the dynamic tension between the interests of differing stakeholder groups as well as changing market conditions.

In recent years, there has been an increasing and more focused discussion on organizational value. From an asset management perspective, the concept of value has morphed from a purely, but very important, financial dimension to a broader understanding that includes the value expectations of stakeholders, whether management, shareholders, or customers.

This requires strategic clarity and resolution. For example, at a strategic level, a conventional car manufacturer like Volkswagen made a decision to produce only electric, zero emission vehicles from its plants in Europe by 2035.

Considering both the market switch toward electric vehicles (EVs) and the increased opposition by environmental activists toward fossil fuel vehicles, Volkswagen’s strategic positioning has massive implications for:

- Asset investment strategies;

- The management of existing assets;

- Its workforce in the conventional factories;

- Research and development funding.

Balancing these demands, Volkswagen decided to:

- Launch a brand new state-of-the art production plant in Wolfsburg for its Trinity EV to produce 250,000 units annually;1

- Refurbish two of the four existing production lines to produce another 250,000 EVs, with the remaining two lines still capable of 250,000 combustion engine units;

- Invest heavily in lithium battery manufacturing, aiming to achieve 75 percent EV production in Europe, with combustion vehicle production being phased out by 2035.

The goal of ISO55000 is to provide asset-intensive organizations with a guideline for establishing a management system.

To achieve optimal value enhancement requires a clear alignment between the strategic objectives of an organization and how the investment in existing and new assets can deliver value reinforcing these strategic objectives.

In 2014, the ISO published ISO55000. The management system aligns directly to strategic organizational goals and drives the operation and management of the assets toward reinforcing these strategic goals.

ISO55000 defines asset management as the function that “coordinates the financial, operational, maintenance, risk, and other asset-related activities of an organization to realize more value from its assets.”

The ISO55000 standard has been published in a number of languages, is being widely adopted across multiple industries, and will inevitably play a role in the strategic planning of most asset-intensive organizations.

Enabling Improved Decision-Making

It is clear that value addition or erosion happens in the constant tug-of-war between differing demands. Management is challenged daily to resolve these demands by making tactical and strategic decisions. These decisions, whether right or wrong, have an impact on organizational value and, ultimately, success. In a single day, a firm may face decisions on whether to replace a partially worn seal on a pump, make budget cuts, invest in a new plant, upskill the workforce, run double shifts to meet customer demand, research new online monitoring systems, and address what level of stores inventory should be held. These are all complex decisions and without direct supporting experience or aligned evidence, also very challenging.

There are a variety of decision demands:

- Technical – replace the pump seal

- Cash driven – cut the budget

- Strategic (long-term ) (prioritizing research and development expenditures to enhance intellectual property, invest in new plant)

- Productivity related – running double shifts

For organizations to be successful, it is essential that consistent value-enhancing decisions are made. Consistently making poor decisions erodes value and making a combination of good and bad decisions simply blunts organizational endeavors. It is, therefore, of huge importance to provide both context and supporting information to the decision-maker.

Quite often, decisions from a higher managerial level take precedence over decisions emanating from a lower level, with the latter having to simply pave the way or resort to less robust, propping up alternatives. In other situations, short-term objectives (e.g., cutting corners to reach output targets) relegate more critical issues to the sideline.

The industrial experiences since 1992 are loaded with examples of poor asset management decision-making leading to erosion of organizational value. A case in point is the 2010 BP Deepwater Horizon oil spill catastrophe that resulted in at least $65 billion in fines, penalties, recovery costs, and cleaning and environmental reparation expenditures. Add in billions of legal costs and the fact that BP had to siphon funds away from other projects in the pipeline to meet these costs, thus running up immense opportunity costs, and the extent of value destruction is obvious.

This value destruction happened because drilling priorities to meet certain targets took precedence over maintenance issues and “fake data was entered to circumvent the system.” Figure 3 illustrates this clearly.

2

With a small investment, BP

3 could have had an organizational management plan fed by supportive data that most probably would have provided sufficient risk management barriers, which could have risk managed these events. This strategic combination of enabling capabilities provides organizations with an unfair advantage that, week after week, month after month, and ultimately in the long term, will improve organizational value.

Driving Better Decisions Through an ISO55000 Asset Management System

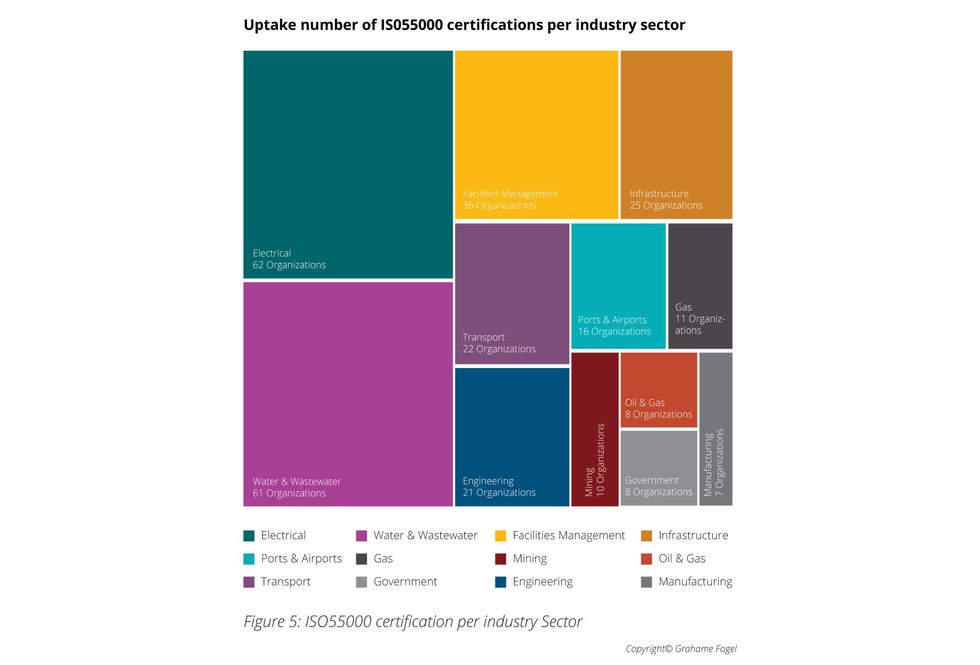

Uptake Number of ISO55000 Certifications per Industry Sector4

The ISO55000 standard requires a strategic approach to asset management, with the Strategic Asset Management Plan (SAMP) outlining the organization’s approach to create asset management value. The SAMP is the main aligning backbone of ISO55000. Senior management signs off on the SAMP, thereby binding management to the support of the execution of the strategy. Within the SAMP is the requirement to identify the key asset management stakeholders and their needs. When this is done properly, the value needs of all stakeholders are clearly understood and aligned to the goals and outcomes of the asset management system.

Another important pillar of ISO55000 is the development of individual asset management plans (AMPs) for key strategic assets.5

These are individualized, taking into consideration the planned life span of individual assets and providing a comprehensive view of both the tactical and strategic requirements of caring for each asset through its entire life.

Developing AMPs has proven to be an extremely useful approach to asset care and many organizations are deriving significant contributions of value from better operational maintenance and strategic capital investment as directed by the AMPs.

Real life experience shows that the development and implementation of AMPs take asset care and decision-making surrounding the asset to a much higher and value-adding domain.

There are several other useful components of ISO55000 that fall beyond the scope of this article that can be seen in the ISO500x suite of AM standards shown in Figure 4.

ISO55000 brings together the best thinking and experience of asset management practitioners from around the world and by adopting ISO55000, organizations embrace a discipline and structure for decision-making that translates into long-term value enhancement.

These process-oriented approaches to asset management can be further enhanced by the strides made in digital and technical developments.

The Digital World and Improved Decision-Making

Big data, digitization and the promise of a new future with interconnectivity between machines in the Internet of Things (IoT) are hot topics. However, when one digs around, the applications within asset management remain low. It is not because the premise is not real, but rather due to a range of barriers.

These barriers include, but are not limited to:

- Starting digitization projects without strategic alignment and an understanding of the information-based evidence required to manage risk and opportunity in the organization;

- The perception that incomplete data or data with potential errors/inaccuracies has no value;

- The challenge of integrating and matching different data sets, probably in different data formats, for example, technical, operational and financial data are captured in different systems;

- The lack of skills to work with big data or a poor conceptualization of what to do with the data and where value realization lies;

- Digitization of existing and mature plants (e.g., oil refineries) is more problematic than designing smart plants from scratch;

- Absent or inadequate processes that translate the data to information, knowledge and response protocols.

While this promise of a new future has already resulted in the exponential growth of a data generation, the advantages of big data based algorithms are still, for most industries, only in a first phase of unlocking value. Though the cost of collecting and housing data decreases, most companies are still feeling their way into the world of artificial intelligence and contextualizing this learning into improved decision-making.

The reality in asset management is that there has been a substantial accumulation of several forms of data in various data management systems for decades.

There is real value from unlocking and understanding what is in that data. This remains, however, a daunting challenge for most organizations6. Many will require assistance to effectively structure digitization projects to ensure value delivery.

In the context of value addition or asset performance management, data can be directed to:

- Improve operational performance;

- Focus investment planning.

These two components will be dealt with separately as they vary in scope and intent, supported by different methodologies and management philosophy.

1. Improve Operational Performance (Asset Performance Management)

The promise of integrating asset performance data into an aggregated platform allowing deeper and broader analytics has been around for some time. Real-life experience is beginning to show some benefits of this approach. Many organizations have invested significantly without reaping the expected returns, in some instances viewing the benefits of investing in the digital world as overrated. However, the obstacles to benefit realization are often more to do with uncoordinated internal processes within the firms or, in other instances, the firms/organizations simply do not have sufficient organizational and institutional maturity to unlock the benefits of improved APM.

This unbalance can be overcome significantly by combining the implementation of ISO55000 with a parallel investment in asset data analytics.

Before embarking on any data project or investment, firms should consider the following six questions:

- Which question will be answered if we collect, analyze and understand this data?

- Will it benefit the organization if this specific question is answered?

- Can this question really be answered by collecting, analyzing and transforming this data or does it require some additional data?

- What needs to be done to get the data / information / decision / action cycle process in place?

- What needs to be done with new insight to ensure the action creates the value delivery that is expected?

- How can this process be accelerated and automated?

In answering these questions, a perspective about the value that can be added will evolve. Data investments and projects must have clear value targets, as shown in Table 1.

Table 1 – Value targets for data investments and projects

2. Improve Asset Investment Planning

Mature and farsighted organizations are increasingly investing in more scientific approaches to asset investment planning. Asset investment planning deals with the use of investment funds to create the required capacity to meet future strategic requirements of an organization (CAPEX as opposed to OPEX).

The decision regarding investment targets and feasibility within financial envelopes is a very complex challenge. It is strategic in nature and deals with future outcomes based on the best present-day knowledge available.

The opportunity of combining complex inputs into the decision-making process and rationalizing the decision based on best available knowledge offers immense scope for value creation.

The process inevitably starts with a clear view of long-term organizational strategic intent, reinforcing the argument for adopting an ISO55000 approach, which has this as a foundational requirement.

The development of data for asset investment planning should be based on specific data inputs from the individual assets, including:

- Available budget scenarios and constraints (most important);

- Nameplate data (asset ID);

- Age of asset;

- Risk and operational context of the asset;

- Maintenance history, including major repairs (faults);

- Performance and replacement costs;

- Remaining life;

- Repair and replace scenarios;

- Future use requirements;

- Environmental sustainability requirements/constraints.

There are several mature asset investment support systems on the market that have been tested and proven. Asset investment support systems, like IBM’s Maximo

® Application Suite, help clear the fog of large amounts of accumulated data and transpose the best data into information and representations from which investment decisions can be made.

Measuring Value from an Asset Management Investment Perspective?

The goal of any management team is to create sustainable, long-term value. As previously stated, there is a good opportunity for creating such value from a targeted asset management investment approach. The combination of improving organizational asset management through the use of ISO55000, combined with a targeted use of information to answer specific questions, provides great opportunities for measurable value contribution.

However, one question remains: How is this value measured?

The best method for measuring overall organizational value is the return on invested capital (ROIC) metric. A good AM program will result in an increasing trend in ROIC, a downward trend in value destruction and a flat trend in a static situation. The ROIC value can be compared to industry and geographical benchmarks to ascertain whether the organization is better or worse than the competition (see Figure 6).

Practical, real-life experience has demonstrated that this is the most appropriate metric because it is a reflection of pure value erosion or creation by a management team over time. An increasingly positive trend is what one is looking for here, as it consolidates all the various efforts of an organization from both an operational and capital deployment perspective.

Periodic monitoring of ROIC (say every six months) allows organizations to understand value contribution and make the necessary strategic adjustment to ensure ongoing value contribution.

Conclusion

Change is easy, but making sustainable change that positively creates value from an asset management investment is challenging. However, the combination of a maturity improvement approach, as encapsulated in ISO55000, in concert with decisions founded on measurable, data-based information, holds the best promise for value growth through asset performance management.

Experience shows that ROIC is the best measure for understanding the impact of an asset management approach, and measuring ROIC regularly ensures that organizational value continues to increase, is sustainable over time and is measured by means of a strategic business indicator that has proven credibility.

Asset investment support systems, such as the Maximo Application Suite, provide a closed-loop model for capturing and analyzing data to enable prescriptive maintenance actions. Such systems can leverage data science and artificial intelligence (AI) at enterprise scale, as well as provide solutions for an IoT platform, hybrid cloud, security, and digital twin technology. Asset investment support systems can be deployed as an integrated enterprise asset management (EAM) / APM suite or be a very effective APM solution integrating with the plant maintenance application of your enterprise resource planning (ERP) system.

References

- Hanley, Steve. “New Factory for Volkswagen in Wolfsburg, New EV from Subaru.” Clean Technica: November 2021. https://cleantechnica.com/2021/11/11/new-factory-for-volkswagen-in-wolfsburg-new-ev-from-subaru/

- Macrotrends. “Chevron – 52 Year Stock Price History.” https://www.macrotrends.net/stocks/charts/CVX/chevron/stock-price-history

- Macrotrends. “BP – 45 Year Stock Price History.” https://www.macrotrends.net/stocks/charts/BP/bp/stock-price-history

- International Organization for Standardization (ISO). “ISO55000:2014 Asset management – Overview, principles and terminology.” https://www.iso.org/standard/55088.html

- Fogel, G., Stander, J. and Griffin, D. “Creating and Effective Asset Management Delivery Model.” Uptime Magazine: June/July 2017.

- Fogel, G. and Kemp, T. “The Role of Asset Management in a Constrained Economy.” Edinburgh, Scotland: IAM Annual Conference, 2016.