This paper is a continuation of Part A, published on July 31, 2023, apropos a 7 step approach to assess and measure the condition of ageing assets with respect to physical degradation, loss of performance, and obsolescence.

Definition of Asset Life Extension Projects

The aim of asset life extension (ALE) projects is to extend the useful life of assets through retrofit, upgrade, renovation, refurbishment, or complete replacement. They all have the same objective under different names. Still, the best and easiest way to extend the life of the assets is to take care of the assets from first commissioning through their entire life. However, at a certain point in time, things must move to another level. Think about asset life extension projects as a way to sustain operations.

Risks Associated with Asset Life Extension Projects

The asset life extension projects are not straightforward brownfield projects. They differ in many aspects from the latter and carry risks associated with ageing assets. This makes it difficult to find replicas for direct replacement or to upgrade of existing assets. On this basis, they necessitate thorough risk assessments to ensure that potential risks are identified and mitigated (ISO 31000). The risk assessments should focus on two key factors:

- First-time project: A project to be performed for the first time. There is no previous experience. This requires a detailed risk assessment to address issues associated with scope completeness, safety, technology, reliability, and constructability.

-

First-time contractor: When the selected contractor has no previous experience with identical projects, a risk assessment is required to evaluate the ability of the contractor to handle such projects.

The 7 most predictable risks associated with asset life extension projects (Fig-1) fall into the following categories:

- Contractor: If an open competitive tender is used, there is a risk that the contract is awarded to a non-original equipment manufacturer (OEM) contractor. This strategy carries risks that should not be ignored. The organization is responsible for reviewing and cross-checking the design of the new asset. It should use the full power of its technical authorities—including engineering, reliability, and quality.

-

Technology: The risks are simply too high for prototyping or moving to a new technology that has not been experimented or not been proven under similar operating conditions. In general, many industries, including the oil and gas industry, tend to be conservative in incorporating new technologies for safety and critical assets.

-

Consultation: Scope firming up and involvement of all stakeholders in the pre-project phases is mandatory to avoid new requirements arising too late. There is a risk if the scope requirements are prepared without consultations and inputs from the stakeholders involved in the asset condition assessment (ACA) exercise.

-

Scope Creep: Poor scoping can lead to changes in the requirements with incremental scope, especially if the project is handled as a procurement without the full power of engineering and technical authorities.

-

Operations: Sometimes an asset life extension project is executed, but fails it to achieve the intended objectives. The nightmare scenario is that the project becomes a controversial issue that negatively affects operations and safety.

-

Constructability: A bulky asset that was assembled and installed 20-30 years ago may present logistical challenges. Such an asset might require a special lifting plan, and potentially the demolition of nearby assets. To preempt adverse consequences, construction challenges should be addressed during the study phases.

-

Financial: Investing in an asset life extension project may be a risky decision. It can carry financial losses if the technical solution and materials procured do not achieve the desired objectives, and the materials end up idle in the warehouse.

Response to Asset Life Extension Project Risks?

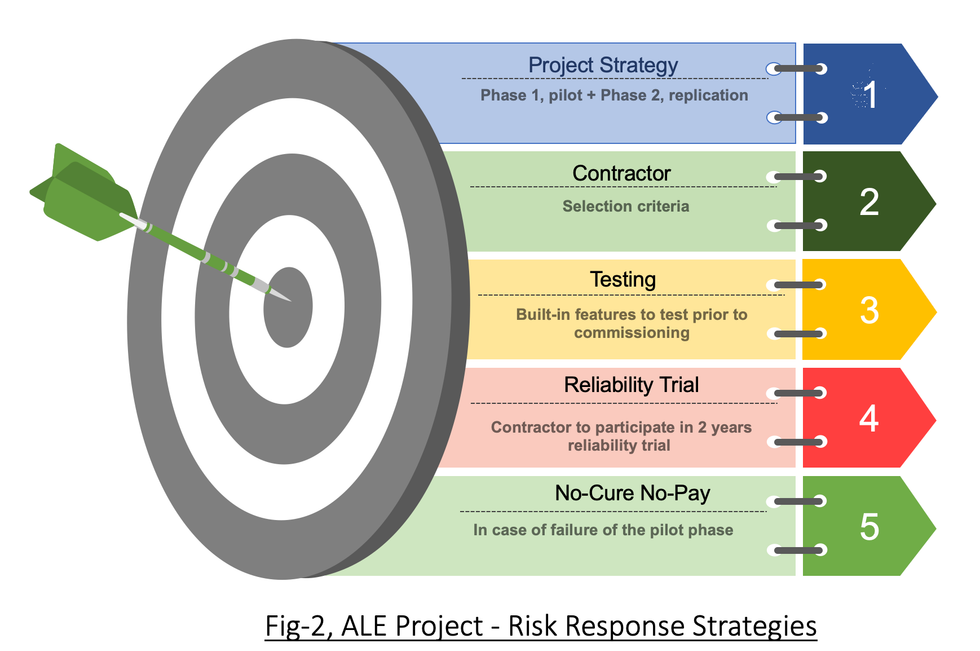

Asset life extension projects require multiple strategies, including risk mitigation and transfer (Fig-2), to reduce the likelihood and consequences of the associated risks. The strategies can be adjusted according to the project scope:

Mitigate the risks:

- Strategy: Projects involving many identical assets can be implemented in two phases strategy. Phase 1 is for one asset and phase 2 is for replication for the remaining identical assets. A pilot phase allows for issues related to safety, scope, design, and materials to be identified, addressed and resolved on a small scale before replication and implementation in phase 2.

-

Contractor selection: The organization should use strict imperatives criteria for the selection of the contractor to ensure that he has adequate experience and resources to complete the project successfully. The contractor selection is the responsibility of the organization and as such, the contractor risks should be assessed beforehand.

-

Testing: Before commissioning, the contractor should ensure that the design has built-in testing facilities to verify all critical functions.

Transfer the risks:

- Reliability trial period: The contractor should guarantee the reliability of the proposed solution. They should expect to participate in a reliability trial period for up to 2 years, to prove that the guaranteed reliability can be achieved. During this period, the contractor will be required to correct any deficiencies identified as the source of unreliability—both in defective material or design. Once the pilot phase is successful, the project can then proceed into the full phase for the remaining assets.

-

No cure no pay: The contractor must accept this clause in case the pilot phase is not effective, and the proposed solution failed to achieve guaranteed reliability.

Conclusion

We identified the risks and costs of a failed asset life extension project and how they can easily outweigh the benefits and expectations of the projects. We also identified the actions that can be taken to manage the risks. This cautious approach may represent a pathbreaking change for some organizations. If implemented, it would result in more confidence and would be a capability multiplier in managing asset life extension projects.

References

ISO 31000 (2018) Risk management guidelines